If a Colorado resident dies without a will, their assets will be passed pursuant to Colorado laws called intestate succession. Colorado intestate laws decide how an estate is distributed without an estate plan or will. These intestate laws do not take into consideration the wishes and desires of the deceased.

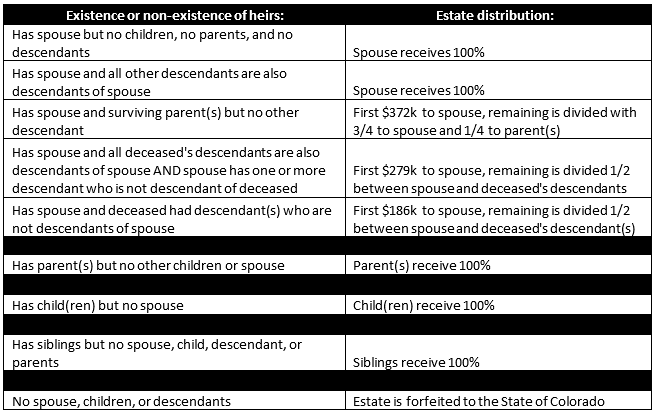

To evaluate how the estate will be distributed, the law looks to see if the deceased had any surviving spouse, children, parent(s), siblings, or other relatives (called descendants) at the time of death. In Colorado, descendants are individuals of lineal relationships. Once it is decided who has survived the deceased and what the survivors’ relationships are, the intestate laws dictate who gets a portion of the estate. The intestate laws provide for a multitude of different scenarios and can be confusing. Below is a summary of the different scenarios and how Colorado intestate laws divide the estate. *Each amount (not the percentages) is subject to change with the current year’s cost of living adjustment.

Other scenarios not listed above have nuances that require further analysis. The lawyers at Burnham Law can evaluate all other scenarios using Colorado’s intestate laws.

It is important to remember that some assets are not affected by Colorado intestate laws because they are co-owned or have a named beneficiary. Some common examples of this:

- Joint bank accounts

- Insurance with a named beneficiary

- Retirement plans with a named beneficiary

- Real property held jointly with right of survivorship.

To avoid the State of Colorado making all the decisions on your estate, Burnham Law can create a comprehensive estate plan and have your assets distributed exactly as you desire.

However, Burnham Law understands life is unpredictable, and the unfortunate happens. Our attorneys at Burnham Law represent heirs, descendants, and personal representatives in intestate actions.